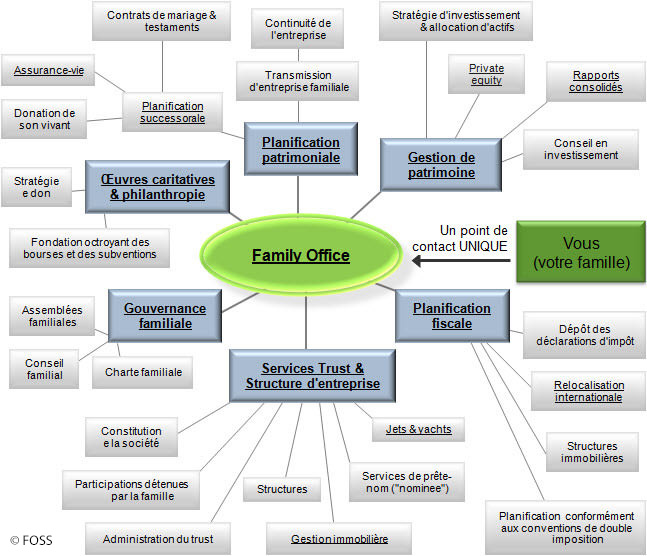

In the grand tapestry of high finance and wealth management, a new chapter is being woven. A palpable shift is taking place, and at the epicenter is the merger of two ostensibly diverse elements: Family Offices and Artificial Intelligence (AI).

Fast forward to 2024, where the mechanisms of wealth preservation, accumulation, and transfer are no longer reminiscent of a bygone era. Instead, these operations are now running on highly sophisticated AI technologies. This article will dive deep into this transformative synergy, highlighting how family offices – those elusive, often enigmatic entities that manage the wealth of the world’s most affluent families – are embracing the efficiencies, insights, and capabilities of AI. Welcome to the revolution of the financial landscape where discretion meets data, and tradition converges with technology!

The Dawn of AI: Disruptive Trends in Family Office Operations in 2024

Seeing the transformative shift brought about by artificial intelligence (AI) in various sectors, family office operations have also started adopting this revolutionary technology. AI, known for its accuracy and efficiency, is disrupting traditional family office operations and initiating a new approach for wealth management. Particularly, three developments are seeing a rising trend in 2024.

1. Automation of mundane tasks: Family office operations consist of a lot of paperwork and mundane tasks that can consume a significant amount of time. AI is automating these tasks, further enhancing productivity and reducing the chances of human errors. This gives more time for workers to focus on strategic tasks.

2. AI-driven insights: AI has brought about a significant change in the decision-making process. By making the most of AI technologies, vast amounts of data can be processed in no time. These AI-driven insights could potentially reshape investment strategies and risk management practices in family offices.

3. Enhanced cyber security: The online storage of sensitive data significantly increases the probability of cyber threats. AI is improving cyber security by offering real-time threat detection, thereby securing the digital assets of family offices.

AI may be in its infancy in terms of its potential, but it is already making a massive difference in this sector. It has become a great ally in driving the operational efficiency of family offices to new heights. While there may be reluctance to the adoption of AI, the benefits of AI are undeniably vast and significant, not to mention essential in staying competitive in the digital age. The dawn of a new chapter in family office operations has indeed begun with AI playing a transformative role in reshaping wealth management.

Key takeaway: As we move forward in 2024, family offices must adapt to this trend and harness the power of AI to remain agile and efficient in the ever-evolving digital world. The era of digital transformation is here, and how quickly family offices can adapt will determine their success.

Decoding the AI Revolution: Unpacking the Benefits of AI for Family Offices in 2024

Imagine a hybrid of the traditional way family firms operate laced with the heightened competence of Artificial Intelligence (AI). As we journey into the future, Family Offices are not just embracing AI; they are undergoing a AI revolution. Powered by analytics and deep learning algorithms, the AI revolution is ushering in tools that aren’t just resilient but are also accuracy and efficiency-driven, a vital cog aimed at improving overall performance, cost-resilience and decision-making quality.

AI unfolds numerous benefits for family offices, and some of them are as follows:

- Automated Processes: From manually entering and analyzing data to investing in sophisticated AI software, the future has arrived. Automation now takes center stage, while humans focus on strategic decisions. Tasks such as data entry, auditing, compliance, and reporting are now handled efficiently by AI, freeing human resources for more nuanced tasks.

- Wealth Management: With algorithmic trading and robo-advisory services, the wealth management landscape is being shaped by AI. It brings transparency and efficiency, delivering personalized financial advice based on data-driven insights and reducing the risk of human error.

- Risk Management: AI leverages predictive analytics and complex algorithms to provide foresight into potential investment risks, enabling proactive risk management and mitigation strategies. With AI, family offices can have a laser-sharp focus on more promising and safety-aligned investment ventures.

- Real-Time Decision Making: Rapid technological change and market volatility require quick, accurate decision-making. AI helps in delivering real-time information and insights, enabling family offices to respond swiftly to market changes.

In a nutshell, AI is poised to redefine the modus operandi of family offices, thereby creating and sustaining value across all dimensions of operations. As we advance into 2024, the integration of AI in family offices is becoming not just beneficial, but vital.

Transformative Technology: Harnessing AI for Enhanced Decision-making in Family Offices

The advent of Artificial Intelligence (AI) has triggered a paradigm shift in numerous sectors including family offices, primarily serving higher net worth individuals or families with massive financial holdings. It has become increasingly essential to harness these trailblazing technologies to streamline operations, minimize risky investments, and allow for more sophisticated and streamlined decision-making processes.

AI applications like predictive analysis, robotic process automation, and natural language processing have begun to shape the future of family offices. Advanced logical models can analyze data on a scale beyond human capabilities and provide valuable insights that can inform strategic decisions. This facilitates the seamless and efficient allocation of resources, which ultimately increases returns and minimizes risk for high-net-worth individuals and families.

– Predictive Analysis: Through algorithms that process historical and real-time data, AI can identify patterns and predict future trends. This helps in making informed investment decisions, mitigating risks and potential losses.

– Robotic Process Automation (RPA): This AI application takes care of repetitive tasks, thus, freeing up staff members to focus on higher priority and more complex tasks requiring human intuition and judgment.

– Natural Language Processing (NLP): Used to comprehend and convert human language into data, NLP technology can be used for analyzing written documents, extracting insights and summarizing financial reports, which aids in faster decision-making.

In this constantly evolving digital landscape, the integration of AI can indeed provide family offices with the necessary tools to enhance their decision-making process. Hence, it’s high time that such establishments embrace AI-powered technology to navigate the unpredictable and complex world of finance successfully.

Plotting the Future Roadmap: Expert Recommendations for Leveraging AI in Family Offices in 2024

The advent of the digital era has made Artificial Intelligence (AI) an indispensable tool for businesses across the globe. Family offices are no exception and integrating AI into their framework can result in seamless operations, efficient capital allocation, and personalized wealth management. Based on the insights from experts, here are some of the most promising strategies for harnessing artificial intelligence for the benefit of both single and multi-family offices.

Firstly, it is essential to deploy AI for data analysis and decision making. Portfolios often comprise varied asset classes necessitating complex analysis. AI can play a vital role in asset allocation by leveraging machine learning algorithms to unlock trends and patterns that are not apparent to the human eye. Despite the complexities, artificial intelligence can filter them into comprehensible insights for better decision making. Another area where AI comes in handy is risk management. Auto learning models can adapt with market dynamics to provide a real-time risk evaluation.

Secondly, experts suggest enhancing client experience using AI-enabled services. Chatbots and virtual assistants, for instance, can offer round-the-clock services, answering queries, and providing portfolio updates. Combining AI with IoT (Internet of Things) can elevate homes into smart residences, aligning with the lifestyle of ultra-high net worth individuals. Lastly, for family offices with philanthropic activities, AI can optimize the fund allocation by analyzing and predicting the impact of various social causes.

Lastly, as we advance, it would become imperative for family offices to not only understand AI but also stay updated with its ongoing and forthcoming developments. The future might see AI synthesizing with technologies like Blockchain to offer decentralized finance or dealing with complex assets like cryptocurrencies. Thus, regular knowledge updation and training of staff in AI would be necessary.

HTML:

The advent of the digital era has made Artificial Intelligence (AI) an indispensable tool for businesses across the globe. Family offices are no exception and integrating AI into their framework can result in seamless operations, efficient capital allocation, and personalized wealth management. Based on the insights from experts, here are some of the most promising strategies for harnessing artificial intelligence for the benefit of both single and multi-family offices.

- Deploy AI for data analysis and decision making - Even with complex data sets and asset classes, AI can simplify and provide comprehensible insights for better decision making. AI is also capable of adapting to changing market dynamics to provide real-time risk evaluation.

- Enhance client experiences using AI-enabled services - Chatbots and virtual assistants can provide 24/7 services, portfolio updates and answer queries. AI combined with IoT can transform homes into smart residences, perfectly suited to the lifestyle of your high net worth clients.

- Stay updated with AI developments - The future of family offices could include AI technologies such as blockchain and handling of complex assets like cryptocurrencies. This makes regular knowledge updates and staff training in AI essential.

Concluding Remarks

As we gaze into the future of family offices and the remarkable potential of AI in 2024, we find ourselves on the cusp of a transformative era. It is a realm where innovation intertwines with tradition, where human intelligence and technological prowess unite in perfect harmony.

The adoption of artificial intelligence has brought family offices to the forefront of efficiency, enabling their once-arduous tasks to be executed with unparalleled speed and accuracy. In this brave new world, mundane administrative duties have been relegated to the artificial minds of machines, freeing up valuable time for family office professionals to focus on what truly matters – personalized and strategic client services.

With AI algorithms analyzing vast pools of data at lightning speed, families can now make well-informed investment decisions like never before. The nuanced understanding of market trends, risk factors, and investment opportunities, born from the fusion of human intuition and AI analytics, is positioning family offices at the forefront of cutting-edge wealth management.

Yet, as we tread along this path of innovation, we must remain cautious custodians of the power we wield. The delicate balance between machine-driven efficiency and human compassion must never be compromised. Family offices must continue to demonstrate unwavering commitment to their clients’ well-being, utilizing AI to augment their capabilities, rather than replace the human touch that has been a cornerstone of their success.

While the future of family offices may be imbued with the marvels of AI, it is essential to remember that behind every portfolio recommendation, every financial strategy, lies the essence of family leadership, wisdom, and trust. The magic lies not only in the algorithms but also in the empathy and understanding that only human relationships can forge.

So as we bid adieu to this exploration into the intersection of family offices and AI, let us embark on this journey with open hearts and open minds. Let us embrace the transformative potential of artificial intelligence while honoring the virtues of humanity. Together, we shall define a future where families thrive, propelled by the marriage of technological brilliance and unwavering family values.