The One Goldman Sachs Family Office Initiative report, titled “Eyes on the Horizon,” presents the perspectives of 166 family office decision makers from around the world, combined with observations from working with family offices and family-controlled enterprises. The report focuses on family offices that most closely resemble institutions, with more than 70% of respondents having a net worth of at least $1 billion and more than 90% having in-house investment management capabilities. The report finds that family offices have largely maintained their asset allocations despite substantial changes in the market, and have a uniquely steady hand on the wheel, maintaining their overall strategic course while also tactically capitalizing on dislocations that may not be as accessible to other, less-agile investors. The report aims to be helpful to both family offices and non-family offices alike, and invites further exploration of the topic or feedback.

General view of family offices on the market according

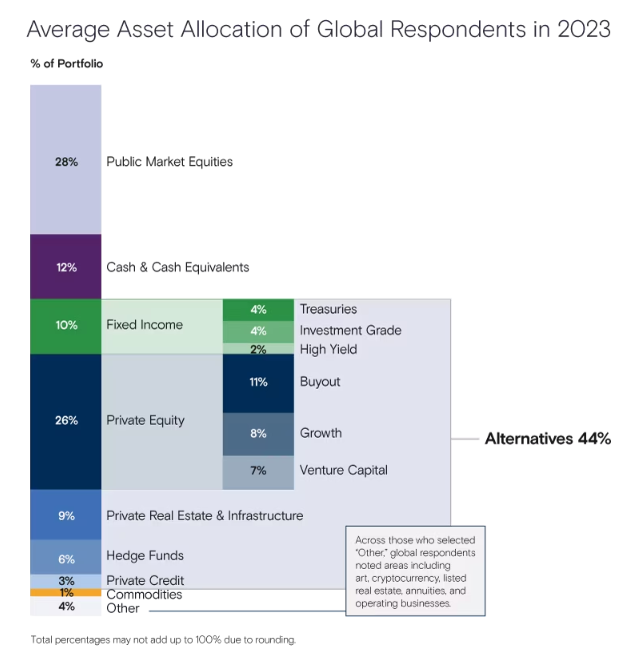

The report states that family offices have maintained a steady course despite the radically altered geopolitical and economic landscape, only modestly adjusting their asset allocations. Family offices continue to hold outsized allocations to alternatives, with private equity, private real estate and infrastructure, hedge funds, and private credit collectively accounting for 44% of holdings. While many expect to maintain their current allocations over the next 12 months, there will be movement, with a considerable number of family offices expecting to increase their holdings in private equity, private credit, and private real estate and infrastructure. Additionally, a substantial proportion (39%) of family offices plan to increase their holdings in fixed income over the next 12 months, possibly in response to the prospect of higher yields in lower-risk instruments.

What is the focus of family offices when it comes to their fixed income and cash-management strategies

According to the One Goldman Sachs Family Office Initiative report, family offices are refining their fixed income and cash-management strategies given the ability to generate yield across lower-risk instruments. Since 2021, global family offices, on average, increased their combined allocation across cash and fixed income from 19% to just over 22% total — 12% in cash and cash equivalents, and 10% in fixed income. Respondents allocated an average of 8% total to Treasuries and investment-grade fixed income, and 2% to high yield. This is consistent with how many ultra-high-net-worth investors are repositioning their portfolios in the current market environment and allocating to fixed income, with that capital serving as “sleep-well” money.

Will family offices be willing to increase risk in their portfolios, and if so, what will they focus on

According to the survey results, family offices have a generally constructive view on the market and may be willing to increase risk in their portfolios. Specifically, 48% of family offices expect to increase their allocation to public market equities, and 41% expect to increase their allocation to private equity in the next 12 months. Additionally, 39% of family offices plan to increase their holdings in fixed income over the next 12 months, possibly in response to the prospect of higher yields in lower-risk instruments. Overall, 35% of respondents indicated that they plan to reduce their allocation to cash and cash equivalents in the next 12 months, suggesting that respondents feel that they have high cash balances today but are focused on opportunistically deploying capital.

One of the interesting aspects of the their report is the breakdown of the allocation within Fixed Income and Private Equity. Family offices have a balanced spread across Buyout, Growth and Venture Capital strategies. Note that family offices had zero fixed income in the 2021 survey, and with today’s higher rates have taken a full 10% allocation.

What are the major takeaways from the themes family offices are investing in

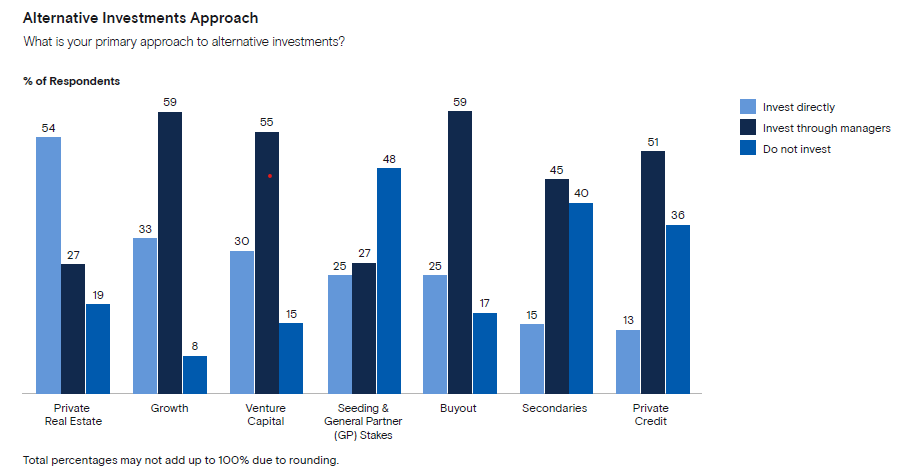

The report states that family offices tend to primarily invest through managers, with the exception of real estate. Venture capital is popular among family offices globally, with regional nuances. The lowest percentage of family offices invested in venture capital hails from EMEA (76%), compared to 91% in APAC and 86% in the Americas. The report also shows the percentage of respondents who invest directly, invest through managers, or do not invest in various alternative investment approaches, including private real estate, growth, venture capital, seeding & general partner (GP) stakes, buyout, secondaries, and private credit.

Please summarise their approach to private investments

According to the One Goldman Sachs Family Office Initiative report, family offices tend to primarily invest through managers, with the exception of real estate. However, family offices with larger asset bases are more easily able to justify the incremental cost and manage the potential risks associated with direct investing. The report also shows that venture capital is popular among family offices globally, with regional nuances. The lowest percentage of family offices invested in venture capital hails from EMEA (76%), compared to 91% in APAC and 86% in the Americas. It would be interesting to dive a little deeper and know the family office’s approximate allocations to alternatives and sub-categories, and how this compare to other investors.