In today’s financial landscape, investors are constantly seeking ways to protect and grow their wealth in the face of inflation, hawkish central bank policies, and market volatility. For family offices and high net worth individuals, alternative investments like private equity can play a crucial role in diversifying portfolios and generating income, all while maintaining a lower correlation to public markets. One such alternative investment that has gained popularity in recent years is secondary funds.

- Secondary funds provide an attractive investment option for family offices and high net worth individuals, offering portfolio diversification and lower correlation to public markets.

- These funds allow for greater liquidity, shorter investment durations, and potentially discounted access to high-quality private equity assets.

- Single-asset secondaries, a rapidly growing segment, offer concentrated exposure to high-performing assets and the potential for higher returns compared to multi-asset alternatives.

Defining Secondary Funds

Secondary funds, or secondaries, refer to transactions where investors purchase existing interests or assets from primary private equity fund investors. The primary private equity investors are some of the world’s largest GPs, groups like Blackrock, KKR, Blackstone, Apollo Global Management or the Carlyle Group. They collectively manage hundreds of funds, containing thousands of companies and investments inside the portfolios.

The most common form of secondary transaction are LP led transactions, where a Limited Partner (the primary fund’s investor) wishes to sell their position. This can be because they want to rebalance or reduce their exposure to the fund or asset class, but equally it can be for non financial reasons. Fewer, but growing in size, are GP led transactions. Here an asset or portfolio company is transferred from one vehicle to another vehicle. This offers the GP additional capital or time to execute a value-creation plan. For detail on GP led transactions, see this excellent article by prequin.

Consider a GP who holds investments that are slow to realise returns, as the underlying investments have not been able to exit as quickly as they’d hoped. This may breach the terms of the fund’s life (usually ten years) while at the same time dragging down the GPs’ IRRs (Internal Rate of Returns). If the GP could instead sell the portfolio, they raise cash to both repay their investors and redeploy their capital into higher returning investments. Sometimes the GP wants to sell a portfolio for non-financial reasons, such as a departure of key person or team managing the portfolio. If you’re a manager with a fund that is deep underwater, it may take many years for the fund to generate performance fees. As a result you and the team decides to leave, orphaning the fund.

Hidden Treasure

With the secondary fund market, GPs can sell their portfolios or assets realising cash upfront or paid over a window of a year. The secondary fund often buys at a ten to fifteen per cent discount (eighty-five to ninety cents on the dollar). The secondary fund then holds the portfolio to maturity (i.e. until the investments exit). The discount at entry price creates attractive upside for the secondary fund. In 2023 due to the economic slowdown, discounts on the secondary transactions have widened to as much as 25%.

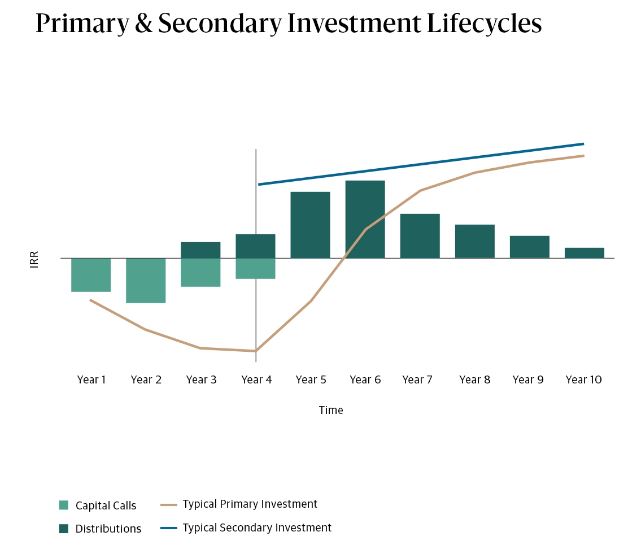

Primary private equity funds generally require three to five years to allocate capital, resulting in a potential delay before investors begin to receive distributions. On the other hand, secondary strategies employ capital more swiftly and often start distributing returns much sooner, sometimes even from the fund’s inception! This is because they are investing in mature underlying funds, unlike the GPs who started them. This approach helps to alleviate the private equity J-curve, where primary private equity funds usually experience negative returns in the initial years due to management fees and other investment expenses, with positive returns only materializing as the underlying investments mature. On average the secondary fund is buying at year 4-5 of the primary fund’s life, when the investments are more seasoned and beginning to return capital.

And there are other ways additional value can be created. In addition to the return from the entry discount, any deferred payment that the secondary fund can negotiate boosts returns further. After all, capital has a time value and if your secondary fund can start returning capital before you’ve finished paying the primary fund GP so much the better!

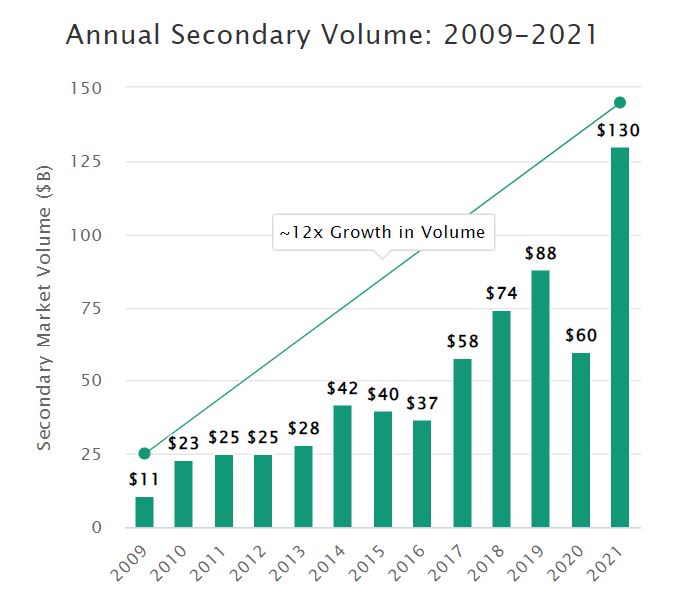

The secondary market has experienced significant growth, with total volume reaching a record $134 billion in 2021. In a time of market volatility, secondary funds present a compelling opportunity for family offices and high net worth individuals.

Source: Blackstone

The Appeal of Secondary Funds

Investing in secondary funds can therefore offer several benefits to investors, such as:

- Diversification: By allocating capital to secondaries, investors can gain exposure to a broad range of assets, industries, and geographies, reducing portfolio risk.

- Lower Correlation to Public Markets: Since secondary fund investments are often in private companies, they tend to be less correlated to traditional stock and bond markets.

- Shorter Investment Duration: Compared to primary private equity investments, secondary funds typically have shorter investment horizons, allowing for a faster return of capital.

- Discounted Access: Secondary fund buyers can purchase interests at a discount to net asset value, providing the potential for higher returns.

- Enhanced Transparency: Investors in secondary funds often have more information about the underlying portfolio or assets, enabling better-informed investment decisions.

The Emergence of Single-Asset Secondaries

Within the secondary market, a rapidly growing segment is single-asset secondaries, which involve the purchase of a single asset from a primary private equity fund. These transactions offer several advantages, including:

- Concentrated Exposure: By investing in a single-asset secondary, investors can focus on specific high-performing assets instead of being exposed to an entire portfolio.

- Risk Mitigation: Single-asset secondaries can help investors avoid unwanted broader portfolio risks and offer a more targeted investment approach.

- Higher Return Potential: Research shows that nearly 62% of secondaries investors target net internal rates of return (IRR) of 20% or more in single-asset secondaries, compared to lower thresholds for multi-asset secondaries.

Navigating the Risks and Complexities of Secondary Funds

While secondary funds offer attractive opportunities, they also come with certain risks and complexities. Sourcing deals, performing due diligence, and executing transactions can be time-consuming and challenging. Investors should consider partnering with a dedicated and experienced team that can effectively navigate the intricacies of secondary fund investing.

For family offices and high net worth individuals seeking diversification, lower correlation to public markets, and attractive returns, secondary funds present a compelling investment opportunity. With the rapidly growing single-asset secondaries segment, investors can now access concentrated exposure to high-performing assets, further enhancing their portfolio’s potential. As with any investment, understanding the risks and complexities involved is crucial, and partnering